Business Insurance in and around Langhorne

Calling all small business owners of Langhorne!

This small business insurance is not risky

This Coverage Is Worth It.

Do you own a pet groomer, a book store or an antique store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Langhorne!

This small business insurance is not risky

Get Down To Business With State Farm

When one is as driven about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for worker’s compensation, artisan and service contractors, commercial auto, and more.

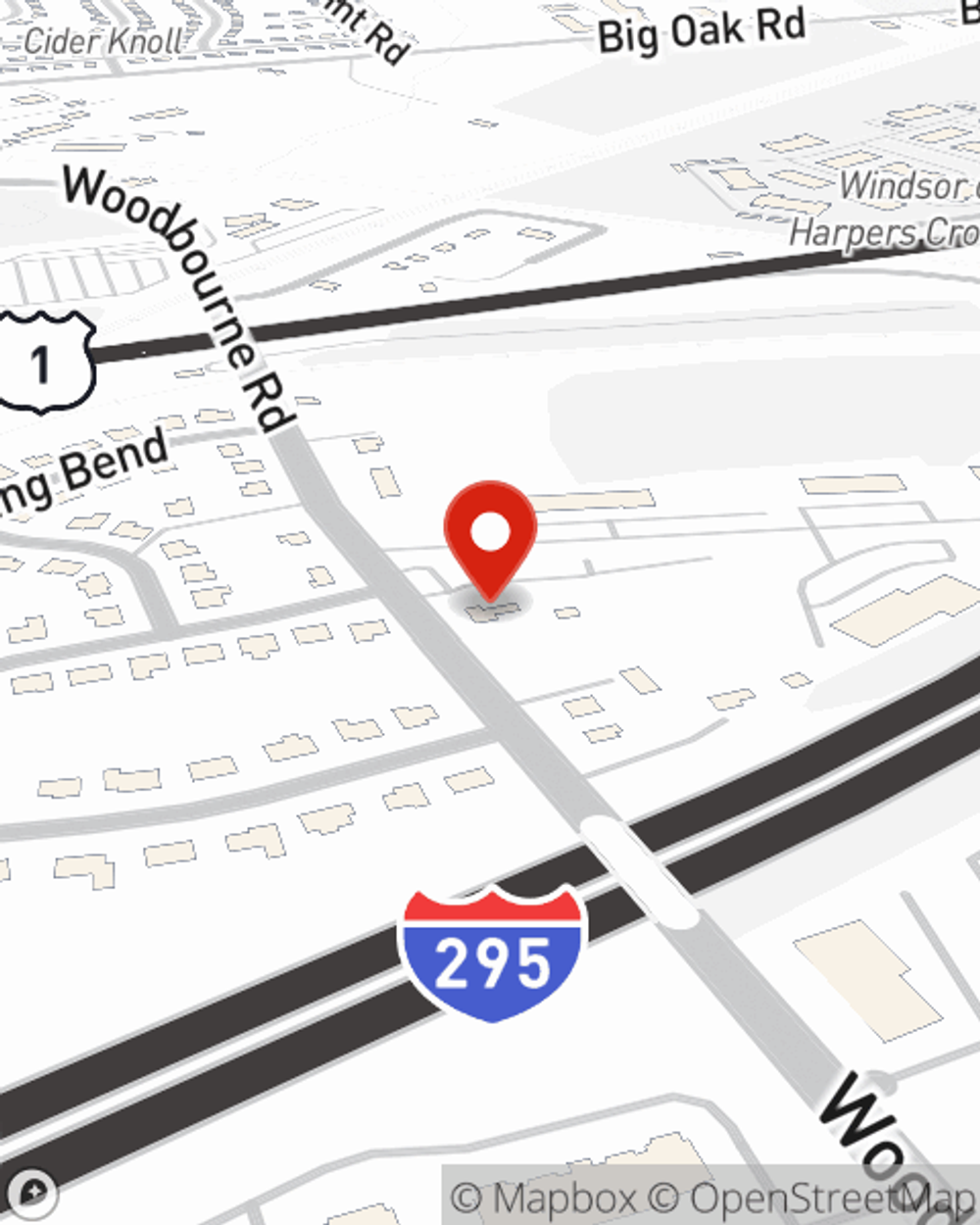

The right coverages can help keep your business safe. Consider stopping by State Farm agent Kevin Seese's office today to explore your options and get started!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Kevin Seese

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.